Is that your entire portfolio. Or just one sleeve of the portfolio.

I’ve put about 10% into each one of those 4 stocks. I have 14 holdings in total, 12 main ones and two smaller ones. Even that I feel is risky for a newbie like me!

My plan is that if I do well, I can then concentrate more in my high conviction picks (i.e. maybe hold say 8 main picks), or if I do badly, then I’ll go back to the Islamic funds which I used to do before!

I’d prefer the former iA!

Interesting point. Risk comes in various flavors

(1) not knowing the biz well

(2) balance sheet risk

(3) valuation risk

(4) concentration risk - too few companies in portfolio

So you feel owning 14 is too many maybe coz some of the companies you don’t know as well …

8 companies can work too. I prefer to be in the 20-25 positions. 8 makes it highly volatile and one of two mistakes or bad luck can jeopardize the result

How do you guys invest in a foreign company, like Mo-Bruk? Whenever I try to search for its ticker “MBR” I get no results in my TD-Ameritrade account. However, from my google search I came across this ticker, “MBRFF”. It appears to be for the same company, however, I noticed the stock does not move the same as MBR. Am I missing something?

I invest in International stocks via Interactive Brokers. They cover 30 odd countries including Poland , where Mo Bruk is listed. I own Mo Bruk directly in Poland.

Often there are sponsored ADRs listed in USA. These are usually on OTC / Pink sheets.

Not a reco.

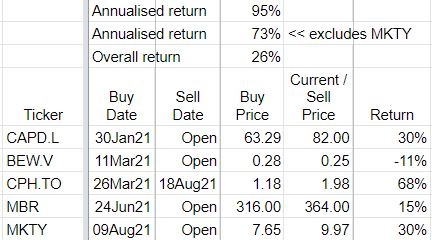

Opened a position in MKTY at 7.65.

It’s a BTC miner, so is linked to BTC price as well as it’s own performance as a business.

A few articles on SeekingAlpha explain it.

Exited CPH.TO at 1.98, +68% return.

MBR announced this last week that they doubled H1 Net Income and EBITDA vs Last Year.

Two comments

- Feel free to take or leave the annualised return. Over time it will become more meaningful to me I think.

- Note to self - the last time I was doing well, like this, I then picked starting picking a load of rubbish because I got overconfident about it all.

Usual caveats…penny stocks like these are high risk, can drop 30% the next day for no reason, and can go to zero. So be careful, and none of these are recommendations…they are just ideas that I have invested in among others. I’m a beginner/novice investor.

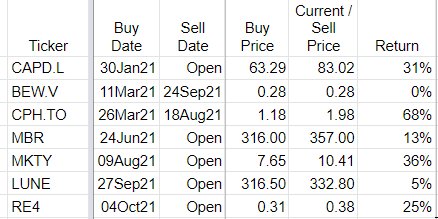

Sold my BEW position at cost.

Bought a couple of energy stocks recently RE4 (singapore) and LUNE (sweden)

Usual caveats…penny stocks like these are high risk, can drop 30% the next day for no reason, and can go to zero. So be careful, and none of these are recommendations…they are just ideas that I have invested in among others. I’m a beginner/novice investor.

Pretty happy alhamdullilah with performance…just hoping the markets stay stable!

Hey As Salaam Walaikum Umar,

Thanks for keeping us in the loop with your journey. Wondering what made RE4 and LUNE interesting for you? Rookie investor here. Sorry if the question is super basic

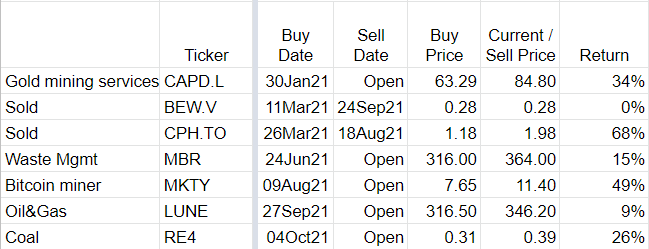

They are in the energy space and very cheap, in the context of commodity prices going through the roof recently. So they have the opportunity to generate serious FCF (relative to market cap) if prices stay high. I wanted some commodity stock in my portfolio for diversification also.

Note they are in off-the-beaten-track countries which is higher risk, and energy is not an area I know anything about - other than the prices are going sky high.

RE4 has an investor presentation which explains it in better detail!

Thanks man! That’s very helpful

SLNH (was MKTY) now +113%…in 3 months.