Hi all

Why companies which produce non Halal Food are marked as sharia compliant. Almost all Food companies produce non Halal Food.

Wouldn’t that depend on the % of non-halal food that is being produced?

Like if a company’s revenue comes 99% from chicken vs. 1% from pork, the 5% rule would say that this is a permissible company to invest in.

Note that “halal food” is a subjective term, this leads us down the rabbit hole of the non-zabiha being halal vs. haram debate, in addition to certain ingredients that are potentially labeled as halal vs. haram.

In the absence of allocating heavy resources to investigate such matters, I think a broad brushstrokes approach might be best. Walllahu a3lam.

Wonder what others think.

Asslamo alaykoum

would it be possible to get the opinion of Sh Joe on this subject.

at the moment a lot of food companies are flaged as persmissible in Zoya.

Walaikum Assalaam,

Thanks for following. This is a great topic. Is there a company, in particular, you’re looking at?

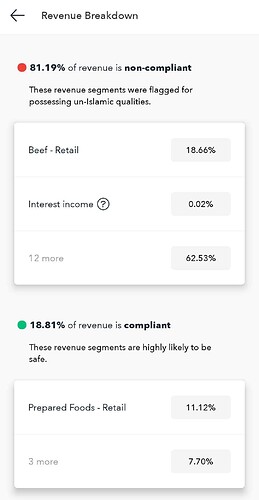

I’ve just taken a look at the five MotleyFool mention here; $BRFS, $HRL, $PPC, $SAFM and $TSN. All of the companies I’ve listed do not pass the revenue screening for shariah compliance. Quick example screenshot below.

Assalan @Farhan

Thanks for your reply

A lot of the top food companies in this list are permissible

Nestlé S.A

Unilever

Mondelez

General Mills

…

They all produce and sell some products which are not permissible.

Thanks for sharing the link. I really had a bit of fun; I’ve taken a look at the revenue segments of the four companies you mentioned above. Each company reports its revenue a bit differently, but the name and description of the revenue segments are the base of what we use to label the revenue shariah compliant.

Here’s what I’ve come across.

- Most revenue segments tell us if they include alcohol. In the case of nestle, for example, they have the following beverage segments; Water, Coffee, Tea, and Cocoa Products and Multitype non-alcoholic beverages. Pretty helpful.

- Now meat is a bit trickier. There are two revenue segments across the four companies that have pork as a possible ingredient. That’s as far as our notes go, so I’ll have to check before I follow up. With regards to not pork, i.e. other meat that isn’t explicitly halal we don’t have anything in our notes right now. In my view, there are a couple of segments that could be affected by it. Will escalate this and see what I hear back.

- Snacks and other foods that don’t have meat but animal-based ingredients such as gelatin etc. I don’t think we have a way of accounting for this, and I feel like as long as we’re looking at a business that is not Muslim by principle, we’ll always come across these problems. The line is easy to draw with food, but it’s everywhere.

What do you think? Does it make sense for a Muslim to invest in larger food brands? Is this is a blind spot in the AAOIFI standard? Is there other information you’d like to see when you’re looking to invest in a food company?