sajjad037

June 29, 2021, 3:03pm

#1

I have prepared a list of Canadain shariya Complaint dividend stocks. Kindly guide if those stocks are good choice for long trem dividend investment? and feel free to suggest Canadain shariya Complaint dividend stocks.

Canadain shariya Complaint Monthly dividend stocks:

Canadain shariya Complaint Quarterly dividend stocks:

CNR.TO

ABX.TO

KL.TO

STN.TO

CP.TO

RBA.TO

WCN.TO

NWC.TO

ABST.TO

SJ.TO

ENGH.TO

BBD-PD.TO

LIF.TO

6 Likes

adib

June 30, 2021, 6:37am

#2

i like the idea of a community built universe of dividend paying and shariah compliant stocks!

1 Like

saad

June 30, 2021, 3:03pm

#3

I can’t comment on the specific companies you’ve listed but here are some of the key metrics worth looking at when evaluating dividend stocks:

Payout ratio (% of the company’s earnings paid out as dividends) should ideally be less than 55%.

Debt levels/coverage (specifically net debt/capital and net debt/EBITDA ratios)

Are the company’s sales growing moderately over time?

Have dividends been growing over time? (see Dividend Aristocrats )

Did the company cut or maintain dividends during a recession?

4 Likes

hkirefu

July 4, 2021, 12:51am

#4

nice list !

how about Franco-Nevada Corporation (FNV.TO)

BBD-PD.TO looks to have a high debt level (it is part of BBD-B.TO if not mistaken)

SJ.TO with ~ 800mm of debt may be crossing into non-compliant based on criteria

1 Like

Riri

February 8, 2022, 10:55pm

#5

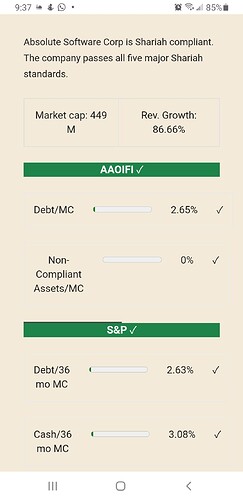

Is ABST.TO sharia compliant? The zoya app says no but I checked Muslim Exchange and it says it is compliant

Farhan

February 9, 2022, 2:13am

#6

At the moment ABST fails shariah compliance because its interest bearing debt compared to its market cap exceeds the 30% ratio we look for.

To get a better understanding of how we assess shariah compliance take a look at our FAQ page.

https://help.zoya.finance/en/articles/4189798-how-do-you-determine-shariah-compliance

With those who have access to Muslim Exchange, how do they come to their conclusion? What does the decision look like?

Riri

June 23, 2022, 1:41am

#7

This is what Muslim xchange lists for the compliance.

1 Like