Salam, a question - who deals with it? Share if there are any, please. For instance I read information about Saudi Aramco. Here is the link. Saudi Aramco raises $6 billion with debut sukuk | Reuters

Salam Malik,

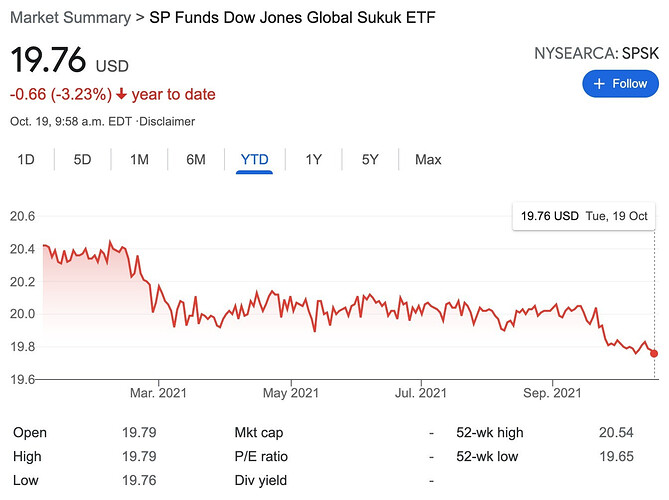

There are indeed limited options to invest in Sukuks, particularly for Muslims living in the West. However, last year we saw these options expand with the launching of SP Funds Dow Jones Global Sukuk ETF. You can use this ETF as a ways to invest in Sukuks from the US, but it is unlikely that there are options for investors to invest in individual company’s Sukuks because we don’t really see companies issuing these instruments, however the above mentioned ETF is a good alternative. For more details about this fund, please read here

Thank you for using Zoya.

Taha

Team Zoya

Aleykum assalam! Many thanks.

Salam,

It’s interesting. I wonder whether there is something similar elsewhere - i.e., in the UK or EU.

Cheers,

Eric

Salam, besides SPSK there is AMAPX and WISEX mutual funds for the US. I personally invest in AMAPX but am open to substituting some or all of those with SPSK if they do better. This is what I use for what otherwise would be excess idle cash sitting in the bank. If anyone is aware of other options accessible within the US let me know.

FYI, to compare performace I look at the hypothetical growth of 10K invested (capital gains plus yield). So far Amana funds have done better since SPSK was created:

For all of the Amana mutual funds there are institutional shares that give slightly lower fees but with a minimum 100K initial investment.

BTW if anyone knows of another free website that shows hypothetical growth of a list of ticker symbols and is easy to use then please share!

This tool by Portfolio Visualizer is great for backtesting: Backtest Portfolio Asset Allocation

Thanks @saad , I tried that site out with the same inputs to cross-check. Interestingly the end amounts matched for WISEX and AMAPX, but SPSK differed ($10,330 in JH’s tool and $10,245 here): Backtest Portfolio Asset Allocation

Fyi, you can use Wahed Invest as a robot investor that allows you to create a portfolio mainly based on sukuk (low risk/low reward) , normally such portfolios yields something around 2.5/3.5% , wahed gets 0.85% fees on profit if not mistaken and they do not require minimum ticket.

Has anyone tried opening an Islamic Bank Account and investing in sukuks through that?

Pakistan has a new Islamic Certificate (https://www.bankalhabib.com/naya-pakistan-certificate) and some countries in the Middle East (Qatar, UAE, etc) also have Islamic Banks that may be open to foreign clients.

How does the SP Funds Sukuk ETF actually work? Is it multiple sukuks combined since it’s an etf?

Are Sukuk as low risk as thought to be ? There is currency risk as the underlying are issues in no Usd I assume ? Please correct me if I am wrong. Their returns are low single digits it seems after fees over long period. ( using amana as a guide). Seems a dividend portfolio might not be a bad alternative.

I was told for Amana participation it is almost all in USD, but I couldn’t see what the actual current percentage is. The propsectus for it says:

Global scope, with a minimum of 50% US dollar denominated securities and no more than 10% in any other currency

As for risk, my assumption is it is much less than the income fund in losing money over the short term, but I could be wrong.

I read the AMAPX prospectus.

Min 50% is USD assets. That means the rest could be non-USD, with 10% max in other single currency. My interpretation is that 50% could be in 5 different currencies (non-USD)

Second point

Upto 35% can be invested in unrated and high yield notes /certificates ->equivalents to junk bonds.

5 year Investor shares returned 3% cagr. I believe equities are a better alternative to this over a long period of time.

Here is WISEX prospectus from 2021

https://sec.report/Document/0001162044-21-000096/

10 year return before taxes : 2.33%

I have reviewed a few Sukuk’s and found them to be nothing more than traditional bonds (backed by assets) with a halal name i.e. Sukuk

Has anyone found a Sukuk, one in which the rate of return is not guaranteed and fixed?

Background: Sukuk’s where originally an IOU, never a means of financing. It was only in 1988 that they took on this role to provide an alterantive to interest bearing instruments for the new industry known as Islamic Finance.

No argument that equities are better over a longer term. Also agree that annual performance hasn’t been great so far, but what other option do we have except keeping money in cash with guaranteed depreciation?

Let’s say there is money you will not use except in an emergency for the next 5 years (e.g. 95% chance you won’t use it), but if you do need it you’d rather not sell at a loss. Let’s say this also is intended to rebalance into equities in a down market.

You could invest some of the cash with the intent to offset the depreciation of the remaining cash due to inflation and zakat dues. Or you could invest more of it into sukuk funds and keep less cash. I’m not sure there is a clear advantage of one over the other but I chose to do the latter.

WISEX has high correlation with stocks and lower returns, so I don’t see the value proposition of holding it instead of AMAPX.

Sure. For each person the situation is different. Rainy day fund (6 months of expenses) i would personally put in cash and not even in a Sukuk fund. Beyond that, whatever combination of funds, etfs, stocks makes sense.

well using Sukuk is only a way of portfolio diversification , yes they yield something around 1.5-2.5% between AMANX , WISEX and SPS, but at least better than keeping the cash in the bank account. they will never beat the stock market for sure, but at the same time this is not meant to. a portfolio should have both exposures in my opinions.

regarding some questions about available sukuks out there, well I have requested same from some institutions but there are heavy barriers of entry. Investing in Sukuk directly with the institutions require a minimum ticket of 100 to 200,000 usd to be able to be considered. HSBC are running such offerings but only meant for high net worth investors.