Hims & Hers Health (HIMS):

Kicking things off with a recap of a telehealth / healthcare company I’ve been excited about for quite some time - and unfortunately my excitement has yet to pay off.

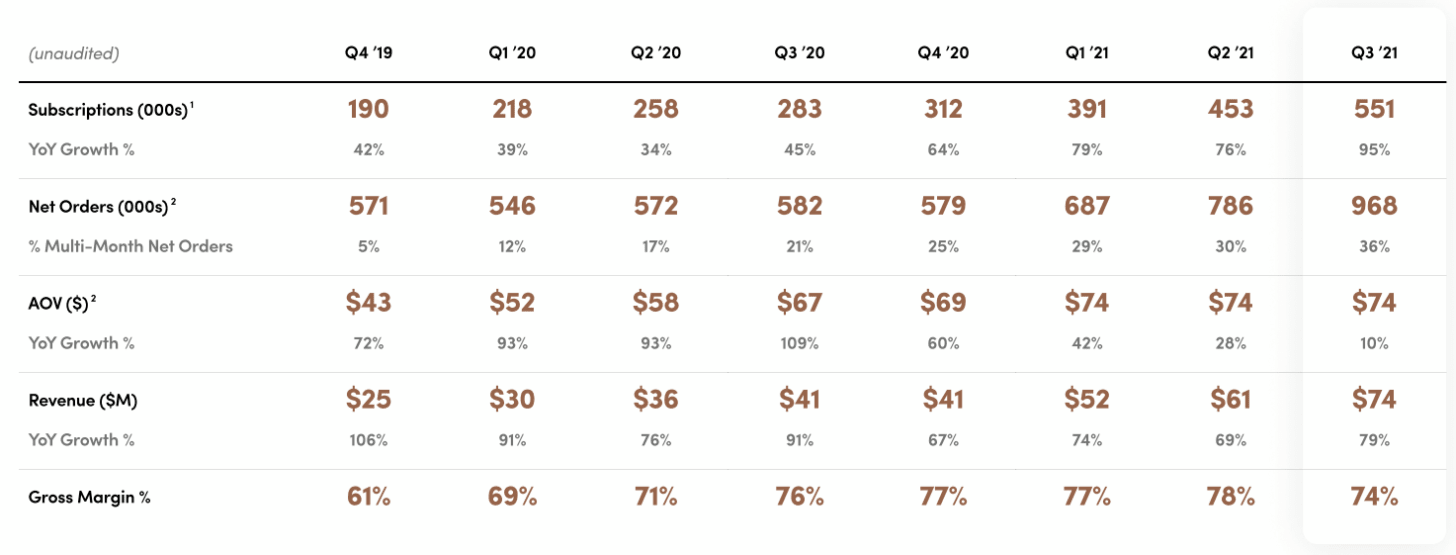

I first began talking about HIMS on Patreon in February of 2021, right before all of our beloved SPACs took a nose dive. The company’s stock peaked around $25 / share, or about ~14X 2022 revenue expectations. Now, the stock trades at only 3.5X 2022 revenue expectations - and this is with 74% gross profit margins.

Let’s talk through their most recent quarter:

- Revenue increased +79% to $74M

- 94% of this revenue is predictable subscription revenue

- 88% long-term revenue retention rates

- Subscription members increased +95% to over 550K+

- Launched their mobile platform - it’s freaking awesome and you should absolutely click this link and visit it for yourself

- Generated 968K net orders, an increase of +66%

- Gross margins decreased -3% from 77% to 74% due to the lower margin revenue derived from their recent acquisitions of Apostrophe & Honest Health

- Apostrophe did ~$5M in topline revenue during Q3

- Partnered with Rob Gronkowski (GRONK!) and Miley Cyrus for marketing

- Entered into a wholesale agreement with Walgreens (~$2M worth of revenue)

- Guided to a revenue increase in 2022 of at least +30%

With a few notable call outs from their earnings call being…

- Mobile Platform

I believe that the launch of our mobile platform is significant not just for our company, but for the industry as a whole. The Hims & Hers mobile platform is a major step in visualizing the radically different vision we have for the future of health and wellness. Our members grew up expecting innovative, digitally native and all-inclusive experiences like Spotify, Netflix and Peloton. Those companies structurally changed the fundamental business models of their traditional industry in favor of everyday consumer experiences.

We believe the health care industry is in need of that structural change as well, and we view today’s launch as a major step toward Hims & Hers building that future.

- General Business

Today, our business is stronger than it has ever been. We added more members to our platform in Q3 than any quarter in our company’s history. Our products line the shelves at nearly 10,000 physical brick-and-mortar locations nationwide, including most recently a nationwide rollout in Walgreens. From the loyalists of JLO and the irreverent lovers of Miley Cyrus to the Sunday night fans of Rob Gronkowski, Hims & Hers is everywhere in omnichannel strategy to build the first true consumer health care brand.

Our strong growth this quarter continues to demonstrate the deep underserved demand of a new generation of experience-driven and brand savvy health care consumers.

Our ability to identify these audiences and deeply connect with them through our brands, and drive engagement and conversion to our unique digital experiences, resulted in Q3 subscriptions growing +95% year-over-year to approximately 551,000. We generated nearly 1 million net orders in the quarter, 968,000 to be precise, which accelerated to +66% growth year-over-year. Year-over-year growth in net orders has accelerated for the last 4 consecutive quarters, which we believe, further demonstrates the deep consumer demand that exists in the market, and our unique ability to capture it.

Q3 marketing expenses were $38 million, right in line with the guidance we provided last quarter. Q3 marketing expenses included the marketing budgets we inherited from Apostrophe and Honest Health, and the upfront investments we made for our celebrity partnerships with Miley Cyrus and Rob Gronkowski.

We are exceptionally pleased with the continued performance and scalability of our marketing. From Q1 to Q3, the variance between our highest CAC quarter and lowest CAC quarter has been less than 3%. Another way of saying this is that CAC has essentially been flat all year. Keeping CAC flat in an environment of increasing rates would be impressive by itself. However, we’ve done this while also scaling subscriptions and exceeding our revenue targets.

- My Favorite Quote

Our current adjusted EBITDA guidance for the year means we are losing, on average, only about $3 million per month, which seems very reasonable given our exceptional growth, impressive scale and the fact that we have over $250 million in cash and investments on the balance sheet.

And that quote is what I want to bring some more awareness and understanding toward for a moment here. This company is trading on the market as if they’re hemorrhaging money every quarter and on the brink of insolvency, despite having a quarter billion in the bank with virtually zero debt.

Simply put, this stock’s price action is completely unrelated to their underlying performance.

Here’s what I see - coming from someone who previously worked in healthcare, as well as someone who is down some -70% on his first purchase of this stock…

Hims & Hers gets it.

They get it.

Their CEO Andrew Dudum completely understands that the next generation of healthcare delivery will not be at a doctor’s office. It will not be this in person, formal, expensive process that it has been for the last 20 years.

It will not be inaccessible to those without employer benefits, or even those with low income.

Andrew is building a company that will have millions of subscribers - paying for these healthcare products both out of pocket and with their insurance. Andrew is building a healthcare company around culture, something Teladoc can’t begin to imagine.

I mean seriously… Gronk, Miley Cyrus AND JLo?

Andrew has made is abundantly clear with his specific product offerings and rollout that he’s leaning heavily into this “land and expand” strategy - wedging his business into underpenetrated markets by selling commoditized products like the above-pictured ED and hair loss treatments.

They’re capturing consumers who would never have been offered these medical products in the first place - then “upselling” / “expanding” across other products while keeping these customers on a sticky subscription model.

This land and expand strategy is successfully used by tech companies all the time, and I think it’s the key to HIMS long-term growth.

I finally wanted to share my thoughts on their sort of “operating thesis” mentioned on the call…

Our members grew up expecting innovative, digitally native and all-inclusive experiences like Spotify, Netflix and Peloton. Those companies structurally changed the fundamental business models of their traditional industry in favor of everyday consumer experiences.

We believe the health care industry is in need of that structural change as well, and we view today’s launch as a major step toward Hims & Hers building that future.

Andrew is building a category-defining healthcare business - similar to how Spotify, Netflix, and Peloton all built tech-first category-defining businesses. These businesses aren’t built overnight, and they don’t come without challenge. Honestly, I have no idea how long it will take before the market recognizes Andrew’s efforts and vision - then assigns the proper valuation multiple to his stock.

But, I do know he’s doing everything right - including bringing the former Netflix CFO of 15 years and current The Trade Desk (TTD) board member, David Wells, on to his board of directors to help him execute on his category-defining strategy.

The same way David Wells helped Netflix do exactly that from 2004 through 2019.

To round off this piece, I’ll be dropping in recent commentary from Wall Street analysts…

Piper Sandler - Sean Wieland:

“Hims & Hers is dominating the market for direct-to-consumer sexual health, dermatology, and hair loss treatments. The stock is currently undervalued, as that their 30% baseline growth rate for FY22 is twice what we had modeled. We do not think HIMS has the clinical expertise, payor support, or human capital / technological infrastructure to completely transform US healthcare at scale. But, at current levels however that is ok.”

- Price Target: $12 / share

Bank of America - Michael Cherny:

“Going forward, we will be looking for any updates around the integration of the two recent acquisitions and as well as any further momentum in the mental health category given management cited this area as a key pillar for the company’s growth going forward.

Following 3Q results we are increasing our revenue estimates for FY21 from $254.3MM to $264.9MM and our FY22 revenue estimate from $317.2MM to $352.4MM. The estimate increase is driven by increased net orders.”

- Price Target: $10 / share

HIMS makes up ~0.1% of my portfolio, but at one point that number was much closer to 1% - continual share price volatility paired with investing new capital elsewhere caused it’s weighting to slip. Before the end of 1Q22, I hope to have this company’s weighting between 1-2%.