Assalamu alaykum,

I’ve been using Zoya for about this entire year, and I am very grateful to the owners and developers for it. I’m 31 and it became the right time for me to start investing about a couple years ago. Zoya has helped significantly for me to feel confident about investing.

Since I started investing, I’ve been looking at a number of resources to strategize for a 20+ year investment horizon. Some of the resources I’ve looked into and used are:

DRIP Returns Calculator | Dividend Channel

Fastgraphs

Track Your Dividends

Dividend Radar (portfolio-insight.com)

Dividend Growth Investing | Facebook

I have a few different strategies that I want to share. I’m using Robinhood as my brokerage. In that account I have a brokerage, a roth IRA, and a traditional rollover from a previous employer.

Roth IRA

The purpose of my Roth IRA is for long-term investing. My main emphasis here is ETFs, with some growth stocks that I don’t plan on selling. I completed my contribution to the Roth IRA this year, but considering an investment into SMH for the future also (95% Zoya compliance semiconductor ETF, with only holdout being Intel with 35% debt), would be curious to know your view on it.

- HLAL (~20%)

- SPUS (~20%)

- UMMA (~20%)

- SPRE (~20%)

- TSLA (7%)

- NVDA (7%)

- AMD (6%)

Brokerage

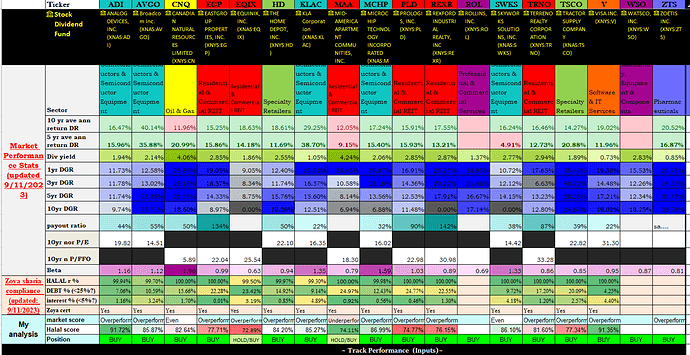

For my brokerage, I’m taking a different, more hands on approach for long term investing, which is a dividend growth strategy. Dividend growth means that the companies increase their dividend payments each year. I currently have 18 different holdings and I track my cost basis, shares, total$, dividend payments, in addition to market performance and Sharia compliance. I plan to add some more positions over time, most probably in January.

You can see that I currently have strong weighting in tech sectors (specifically semiconductors because that is the industry I work in), and currently in REITS. I became interested in halal REITs considering that I found many of them are considered undervalued at this time due to interest rates, and many experts are expecting a correction in this later next year. I have some other holdings for diversification, and I plan to diversify a bit more starting next year with some new additions.

I want to be generous and share my findings with others here, so I am sharing my portfolio here. I am curious about joining any discussion groups for this. To be honest, this has become a great hobby for me this year, especially since I found the confidence using Zoya, and it would be great to share this with others with a similar interest. Let me know if you had any discussion groups or want to share ideas personally with me.

JazakAllah khayr,

Michael