بسم الله الرحمن الرحيم

Assalamu alaikum everyone,

I want to share what I’m looking at for 2026 — not as an expert, but as someone who spent 2 years building a system so I could stop overthinking and start actually investing.

If you sat on the sidelines in 2025…

You’re not alone. I’ve talked to dozens of Muslims who:

-

Watched the market go up 25%+ while their cash earned nothing

-

Kept “researching” SPUS vs HLAL without ever buying

-

Felt guilty about not investing AND guilty about investing wrong

That was me for years. The paralysis is real.

What finally clicked for me

Zoya is incredible — compliance screening, portfolio tracking, zakat calculations, the whole package.

But even after Zoya tells you an ETF is compliant, you still need to answer:

-

Should I buy it RIGHT NOW, or wait?

-

When do I sell if things go south?

-

How do I protect my capital when the market crashes?

That’s the layer I built on top of Zoya: timing, momentum, and capital protection.

Why? Because here’s the truth:

SPUS in October 2022 (down 30%) vs SPUS in January 2022 (at peak)? Same ETF. Same halal status. Totally different outcome.

Buy-and-hold doesn’t protect you from 30% crashes. And depending on your time horizon, you may or may not have time to recover.

My framework: 3 buckets, actively managed

Just as you owe it to yourself to manage your deen and health — so does your wealth.

| Bucket | Purpose | Target |

|--------|---------|--------|

| ![]() GROWTH | Build wealth | 60% |

GROWTH | Build wealth | 60% |

| ![]() SAFETY | Protect capital | 20% |

SAFETY | Protect capital | 20% |

| ![]() STABLE | Sleep at night | 20% |

STABLE | Sleep at night | 20% |

The key: I don’t just hold. When growth breaks down, I rotate INTO safety (Gold, Sukuk). When safety assets start running, I increase allocation there.

Inside your 401(k), you can do this tax-free. No capital gains. No penalty. Just move money between ETFs.

My 2026 Watchlist (out of 80+ I track)

I screen over 80 halal ETFs weekly. Here’s what made the cut:

GROWTH: Semiconductors

GROWTH: Semiconductors

Top 3:

-

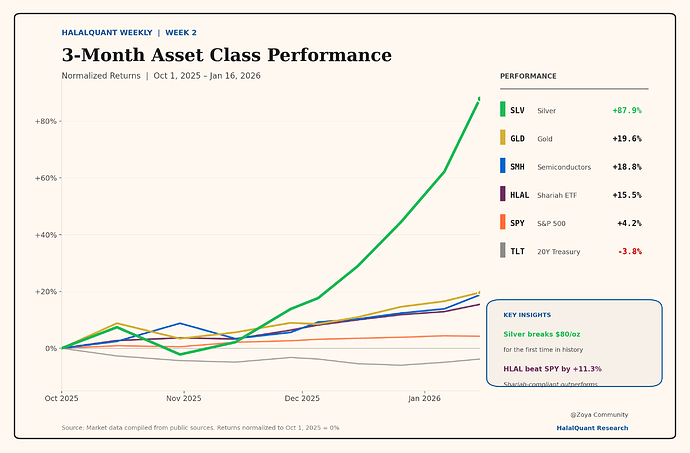

SHOC — 51% in 2025, <1% non-compliant

-

SMH — 49% in 2025, 0% non-compliant, $35B fund

-

SOXX — 39% in 2025, $16B fund

Why semiconductors?

-

No Microsoft, Google, Amazon, Meta drama

-

AI infrastructure = $300B+ spending in 2026

-

Everyone needs their chips

My play: SHOC is #1 in my system right now. But if it drops 10-15%, I rotate OUT to safety.

SAFETY: Gold

SAFETY: Gold

Top pick: GLD (or IAU for lower fees)

Why gold?

-

Zero BDS concerns

-

Central banks buying like crazy

-

When everything crashes, gold protects

What happened in 2025: Gold had a strong run — up 27%. When I saw momentum pick up, I increased my allocation from the baseline 20% to capture that move. Now it’s consolidating, so I’m watching to see if it breaks out again or pulls back.

My play for 2026: Starting at 20% baseline. If growth breaks down OR gold resumes its run, I’ll push this to 40-50%.

STABLE: Sukuk

STABLE: Sukuk

Only option: SPSK

Islamic bonds. Boring. That’s the point.

My play: Always 20% parked here.

What I’m NOT buying right now

SPUS / HLAL: Great ETFs. I own them.

-

But market’s at all-time highs

-

I’m waiting for a pullback OR dollar-cost averaging slowly

What I’m thinking about

I track 80+ halal ETFs every week anyway for my own sanity:

-

Which ones are strong RIGHT NOW

-

Which ones to avoid

-

When to rotate between Growth → Safety

I built something called HalalQuant for this. It’s how I make my own decisions.

Question: Would weekly updates actually help people here? Or just add noise?

Let me know in the comments. If it’s useful, I’ll share more. If not, I’ll just post quarterly.

والله أعلم

I’m not a financial advisor. Just a Muslim engineer who got tired of standing still while everyone else built wealth.

2026 is the year to stop overthinking.

What’s in your watchlist? Do you actively manage or buy-and-hold?

Always learning.

Salaam,

Amad

Bay Area — Zoya since 2021