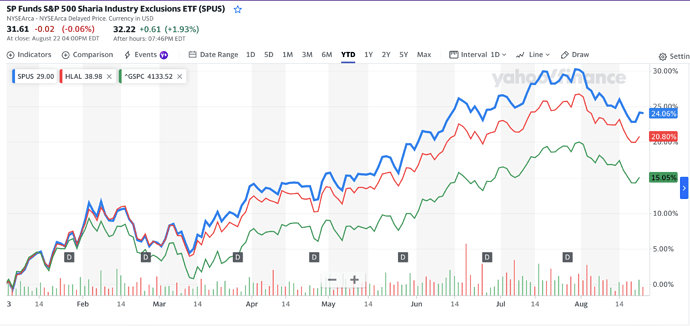

Hey all, I am planning to make an ETF portfolio, I am planning to make US ETFs make up to 60% of my portfolio. Should I pick SPUS, HLAL, or 50-50 between both? The amount of money will be pretty high in this/these funds.

They’re both pretty similar with roughly ~60% overlap in holdings. Comparing them to the S&P 500, SPUS shares a 56% overlap whereas HLAL is at 37%.

Edit (Feb 15, 2025): We’ve published a detailed comparison between SPUS and HLAL on our blog: SPUS vs. HLAL: Which Halal ETF Should You Invest In?

Thank you for your response. I appreciate it.

I understand that they are very similar, but my logic since the amount of money I will have in US funds is pretty high, so I would go with having 60% of the money for SPUS, and 40% for HLAL. I have three main reasons for doing this:

1- both funds have low volume, so dividing the money between them will help me be able to liquidate the stocks easier.

2- getting higher exposure to US companies. I know there is a high overlap between both funds, but having them two make me exposed to wider variety of companies compared to having only one.

3- These two funds might compete to attract new investors since they are the only Shariah compliant funds, so I can use this competition in my advantage.

What do you think about this?

Yeah, I have similar idea, my plan is to do:

40% SPUS

20% HLAL

15% RITA or SPRE

15% Saudi Etf (falcom 30)

10% UMMA

This is my plan, I think it is well diversified and all the fund indices have a good track record.

I do not want to pick stocks individually cause my knowledge is almost zero and I think index funds have a potential to do better than if a professionals pick stocks

What do you think? Is there something I am missing?

Salam, I didn’t hear of UMMA before, nor RITA, and that Saudi ETF (which I don’t think trades in the US, but let us know if there is a US ticker symbol).

Questions: what is their track record (e.g. UMMA)? Are they halal (e.g. for RITA)? A quick look at both and those would be my concerns.

Aside from that, the other three appear to be good options (I invest in all three). There’s no right or ideal portfolio, just one big gray scale of tradeoffs, so I couldn’t recommend specific percentages.

Allaikum alsalam, Hello Omar!

I agree with you, there is no right or wrong with these ideas, they are just opinions!

UMMA is a fund from Wahed company, the fund holds stocks for the best 100 companies outside of the United States. The companies are mainly from Europe, China, Australia, and Japan.

RITA is a fund that owns only real estate stocks, it is very similar to SPRE, but the fund have real estate companies both inside and outside of the US

For the saudi ETF, it is not traded in the US, the fund is traded in Saudi Arabia. The fund constitutes of the best 30 Saudi companies (the fund is shariah compliant)

My idea of having percentages for each fund is to diversify, at the same time, I want to avoid OVER diversification.

Okay got it, so UMMA could be an alternative to AMDWX, which has performed relatively poorly since inception. I wouldn’t invest more than 10% because there isn’t any track record to show it would do better than the other options.

The challenge is sticking to whatever percentage you choose to take advantage of diversification. I had that issue with AMDWX where I always rebalanced into it (buying), but never out of it (selling), and at some point I stopped buying then later decided to exit it entirely in my 401K portfolio.

This is a big part of the challenge for halal funds especially actively managed ones. If we had a 20 or 30 year view of a specific fund, we could be patient with even a decade of underperforming if we believed the next decade could be better. Imagine if 5 years down the line a fund is barely beating inflation, and that’s as long as it existed. We all know the line past performance is no guarantee, but past performance is what gives many the patience needed to hang in there when things don’t look so great.

I looked up UMMA prospectus and it said The Fund is an actively-managed exchange-traded fund (“ETF”). So given that and it just got started, and so far has trailed AMDWX, I wouldn’t personally invest in it yet but don’t see any issue investing 10% if you plan to leave it for long term. I would hold off and at least see it outperforms AMDWX over at least several months before thinking to buy into it. Thanks for pointing it out so I can keep an eye on it. The lower fees may give it an edge in the future.

Salams and Ramadan Mubarak.

Hello Omar, Ramadhan mubarak!

The fund was supposed to be passively managed but due to the ESG consideration, they made it an actively managed fund. The fund main goal is to track the performance of the Dow Jones Islamic Market International Titans 100 Index.

You can find more info here: Bloomberg - Are you a robot?

The net total return for the index during the last 10 years was about 7%. For me, I do not think this is a bad return at all. You can find more information about the index here:

What about shares liquidity? According to investing.com, the average volumes for SPUS and HLAL are 33,348 and 20,275, respectively. Isn’t this a little low? Or it doesn’t matter?

Practically I found it doesnt matter for someone who is an infrequent trader. The pitfall is if the last trades are minutes ago the last price could be significantly off from what the underlying value is in times of high volatility. This is related to a question I posted on whether it’s possible to get the real time current fair value for an ETF.

If you read the prospectus you’ll see reference to every sort of worst case scenario and liquidity risk is one of those. One I just read for SPUS mentions the case where authorized market participants exit the business and no replacement steps in. Those are the liquidity makers step in to buy and provide shares for sale when no others on the open market are (e.g. if you wish to buy or sell a huge sum with a market order any minute it’s open - bad idea though as mentioned above). Another is if the ETF gets delisted from the stock exchange. Well either sounds pretty bad and would likely panic a good deal of folks.

But, what’s the chance practically? If doomsday scenarios are things you dwell on, you should limit your stock investments. Those that do best in this game though have the nerves to hang in there through market panics (keeping in mind that if you’re in cash you’re subject to inflation losses, besides any loss locked in by selling). If Allah wills to try you with a loss you will get it no matter what precautions you take. And we know people who take unreasonable risks and Allah willed their gambles to pay off, so they are tried by gains instead. It helps to keep things in perspective.

Personally I diversify between halal ETFs and mutual funds even though there is significant overlap in underlying funds - just in case one of the various risks happens to one but not the other.

Your mixing the issues, here, brother. I’m not talking about people, who have the stock/etf. My original question is related to someone, who hasn’t bought the etf, yet. Is it a good idea to initiate a position in an etf, that has low relative liquidity? That’s my question.

This is a question of opinion, not fact. The answer shouldn’t depend on whether you already have a position or not. My opinion is the liquidity risk isn’t something significant and I would buy irrespective.

As I see it, you can’t compartmentalize answers but have to view things on a whole to make a sensible decision. Liquidity is a risk factor among many factors. What if something is very liquid but has other more significant risk factors?

Well, if I don’t have an excellent buying opportunity, I simply wait. Charlie Munger once said that I should buy a stock only if it’s shouting to me. I mean the opportunity has to be that good. If such opportunities don’t present themselves, then I simply wait. It can mean that I wait years and years, without investing. Yes, this will mean that I lose 3-5% to inflation every year, but that, I think, is better than losing big on false opportunities. I’m not talking about any particular stock or etf here, by the way. I’m just talking about my personal investing strategy. If the opportunity doesn’t shout to me, I don’t invest.

By the way, I’m not an expert and I am not qualified to give financial or investing advice. So, take what I say with a big grain of salt.

Inflation losses have recently been high single digits for USD. No way to know for sure the future trajectory.

How would you know a deal that screams buy? Is it when the market plunged 10% from the prior day? Is it when it seems you’re staring at the edge of a cliff? Is it after it shoots up 10% after a surprisingly good earnings call? Does it all of a sudden scream buy when it wasn’t interesting the other day or vice versa?

I’m not expecting you to answer this but you and only you can question yourself and judge whether your approach is right for you. You and I are not Munger or Buffett. A big part of doing well in investment is realizing one’s limitations.

In my mind, the scream “BUY!” doesn’t begin with the price. In fact, it ends with it. To recognize an excellent opportunity, I begin with company’s fundamentals, not its stock price. What kind of competitive advantage does it have? Is it a durable competitive advantage? To answer that important question, I need to go through both qualitative and quantitative analysis. When I’m satisfied with my analysis, I try to estimate the intrinsic value. Finally, I compare the intrinsic value to the market price. If there’s a comfortable margin of safety, I buy. It’s very rare to satisfy all of those conditions, in my opinion. Such opportunities occur once in a blue moon, in my mind. That’s why Warren Buffett advised a bunch of youngsters, once, to get a punch card with only 20 spots in it. That’s the number of stocks they’re allowed to buy in their lifetime. Imagine how careful they will be if they can only buy 20 companies in their entire life of 80 or 100 years. Compare that to what many retail investors do nowadays. They treat their investments like a Playstation game. They think that they need to always act. If they don’t act, they lose the game, they assume. The fact of the matter is investing isn’t a game. It isn’t easy. If it was, most people would win. In reality, though, the majority of investors actually lose. Some estimate that 90% of investors lose. The problem is, most investors believe they are among the 10% that win!

Okay brother, if you are able to do such analysis to pick not more than 20 stocks and consistently beat an index fund in the process, then more power to you.

I’m no expert but have read a lot to try to get wisdom from those that appear to be experts. No less than Buffett himself gave the advice for the average person to invest regularly in an index fund through good and bad times, especially through bad. If you do that, you are all but guaranteed to beat inflation by a decent margin over the long term. And that’s good enough for me and for most people.

Salam and best wishes

Rising Inflation, Volatile Market: What Would Buffett Do? - NerdWallet.

Wa alaikum assalam. Best wishes to you too.

AOA WRWB,

I am little confused about Zoya’s filtration of non sharia and compliant stocks in SPUS ETF.

25.45% of stocks are either questionable or non compliant. How do i deal with this?

This is due to the different methods of screening used. We explain this in the app:

Additionally, ETFs sometimes lag behind changes in compliance status - it’s not uncommon for them to be two quarters behind in some cases. That could be another reason for the higher percentage of questionable or non-compliant stocks you’re seeing.