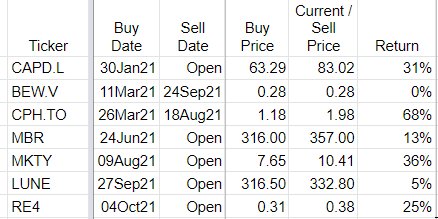

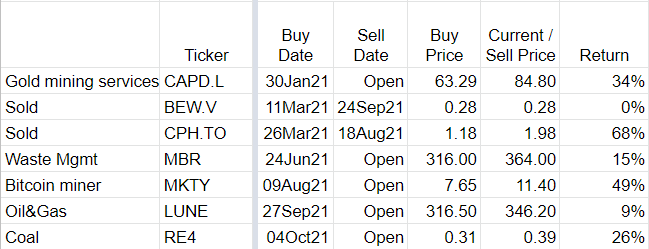

Sold my BEW position at cost.

Bought a couple of energy stocks recently RE4 (singapore) and LUNE (sweden)

Usual caveats…penny stocks like these are high risk, can drop 30% the next day for no reason, and can go to zero. So be careful, and none of these are recommendations…they are just ideas that I have invested in among others. I’m a beginner/novice investor.

Pretty happy alhamdullilah with performance…just hoping the markets stay stable!

Hey As Salaam Walaikum Umar,

Thanks for keeping us in the loop with your journey. Wondering what made RE4 and LUNE interesting for you? Rookie investor here. Sorry if the question is super basic

They are in the energy space and very cheap, in the context of commodity prices going through the roof recently. So they have the opportunity to generate serious FCF (relative to market cap) if prices stay high. I wanted some commodity stock in my portfolio for diversification also.

Note they are in off-the-beaten-track countries which is higher risk, and energy is not an area I know anything about - other than the prices are going sky high.

RE4 has an investor presentation which explains it in better detail!

Thanks man! That’s very helpful

SLNH (was MKTY) now +113%…in 3 months.

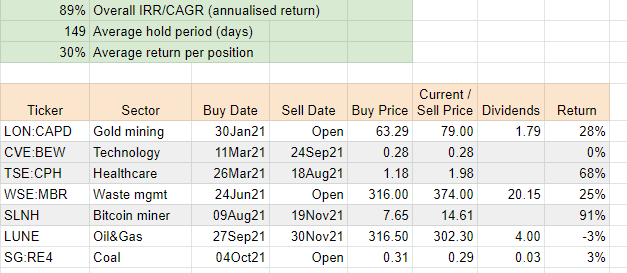

Sold my SLNH position at 14.61 +91% return in 102 days.

Will probably buy this again when BTC looks more bullish. Still an awesome situation.

Awesome @UmarA! Really appreciate the continued tracking. I’m going to rename the Topic title so it can easier for people to catch along.

Thankyou. I was thinking same thing. Going to have a go at LargeCap Stock Picks one soon, probably this weekend iA. Totally different strategy but see what happens.

T. Usmani is founding chair of AAOFI.

It would be beneficial when presenting stocks that we share % of the weighting of the overall portfolio when appropriate.

We have many novice investors, and they do not understand asset allocation nor weighting and this would assist them in understanding the risk of the mentioned equities.

Assume equal weighting.

I’m a beginner myself. Please no-one look to me for learning jzk.

Just to repeat what I’ve said above many times:

“Usual caveats…penny stocks like these are high risk, can drop 30% the next day for no reason, and can go to zero. So be careful, and none of these are recommendations…they are just ideas that I have invested in among others. I’m a beginner/novice investor.”

If anyone wants to learn, I believe there is a thread here somewhere which recommends Peter Lynch, Buffett etc. etc.

Learn from the experts not the total novices with next to zero track record like me.

Sold my LUNE position just now for 302.3, which net of a divi is a 3% loss.

Sold it due to Omicron.

Quick update

SLNH which I exited recently has tanked to 10.00…so happy to have got out. As I mentioned, I think it’s still a great biz plan so am looking to get back in at some point.

Usual caveats…

- penny stocks like these are high risk, can drop 30% the next day for no reason, and can go to zero.

- none of these are recommendations…they are just some ideas that I have invested in among others.

- I’m a beginner/novice investor.

Comments on my little selection of my portfolio

Have added dividends as the return from RE4 is mainly in dividends for me, with share price appreciation a bonus.

CAPD still at 80 mark. I have a target of between 1.00 - 1.60 in the next 6 months for it so holding on.

MBR this is a long term GARP stock for me. 28% so far…happy with that. Results from last Q were good.

SLNH - that one dropped to 10.58 on the Bitcoin dip…so I timed my exit well on that one. As I said…a very volatile one. And I’m watching Bitcoin price to potentially get back into this one.

LUNE…exited too early on Omicron fears…never mind…one for the lesson bank!

RE4…just waiting for the next quarterly earnings and dividend announcement. I reckon USD76m earnings in Q4 which I think is about 24% of the market cap (at the price I paid for it).