I’m trying to increase my dividend income from my portfolio and need some good dividend stocks. Does anyone have any favorite halal dividend stocks?

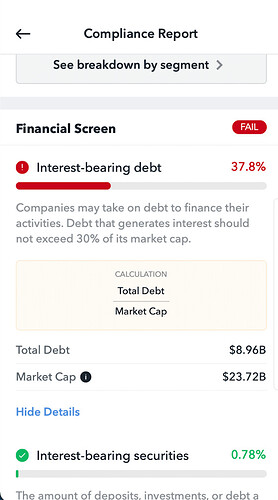

Another question along the lines of dividend investing- Is Realty Income(O) shariah compliant? Zoya says it’s non compliant but I want to know why(not subscribed with Zoya).

I recently commented on another post about some key metrics to look for when evaluating dividend stocks which you can find here. If you’re looking for a quick and easy place to start, I generally tell people to use the Dividend Aristocrats ETF as a reference which consists of high-quality companies that have paid and grown dividends for at least 25 consecutive years. You can see the ETF’s holdings here and then use Zoya to screen out the non-compliant companies.

It appears that the company failed the debt-to-market cap ratio based on its latest quarterly financials. It’s probably worth keeping an eye on it to see if it falls back into compliant territory when they release their next quarterly report later this summer.

Another question- Is the Shariah compliant REIT ETF SPRE even halal to invest in? A lot of the companies are non compliant on Zoya, and that’s why I’m skeptical on this investment.

EDIT: my previous statement was inaccurate.

@Zayd_K I’m just sharing my thoughts but do correct if someone else has more knowledge so could it be that SPRE as a whole is shariah compliant because the debt for example is below recommended % but if you invest in individual companies then it is non-compliant e.g. like lets say one company had more than 30% interest bearing debt so its non compliant but because its only one company out of 37 as an ETF in total debt is below 30% so the ETF is shariah compliant

pfizer, csco, VZ, Home depot aer good starter one, use strategy of diversification, and companies growing and increasing dividend.

Hello maybe this ETF is not sharia compliant ?

Salaam!!!

So lets say real Example. Pfizer just became Non Compliant due to surpassing 30% interest bearing debt. So is it still Halal to keep it for long term and Purify Dividend Payout as instructed?

Please help. InshaAllah i want to do right by Allah SWT

Jazak Allah Khair

Some of the major shariah compliant indexes have published methodologies describing their approaches to managing stocks that transition between being compliant and non-compliant over time.

For instance, the S&P Shariah Index methodology provides a transition period for stocks that change compliance status, rather than immediately changing their status. This avoids frequent index churn caused by minor threshold breaches.

Specifically:

- Compliant stocks that newly exceed the leverage ratio are still considered compliant for 2 periods if overage is <2%. If over 2%, they become non-compliant immediately.

- Non-compliant stocks that newly pass the leverage ratio remain non-compliant for 2 periods. If passing for 3 consecutive periods, they become compliant.

This framework prevents short term blips from causing compliance turnover, while still requiring consistent compliance over multiple periods before including or excluding them from the index.

Thanks so much for this.

But in regards of halalifying dividends from non compliant stock that is within <2% do we follow same ruling like examples gave?? Or we wait 3 earnings calls?