Sold my SLNH position at 14.61 +91% return in 102 days.

Will probably buy this again when BTC looks more bullish. Still an awesome situation.

Awesome @UmarA! Really appreciate the continued tracking. I’m going to rename the Topic title so it can easier for people to catch along.

Thankyou. I was thinking same thing. Going to have a go at LargeCap Stock Picks one soon, probably this weekend iA. Totally different strategy but see what happens.

T. Usmani is founding chair of AAOFI.

It would be beneficial when presenting stocks that we share % of the weighting of the overall portfolio when appropriate.

We have many novice investors, and they do not understand asset allocation nor weighting and this would assist them in understanding the risk of the mentioned equities.

Assume equal weighting.

I’m a beginner myself. Please no-one look to me for learning jzk.

Just to repeat what I’ve said above many times:

“Usual caveats…penny stocks like these are high risk, can drop 30% the next day for no reason, and can go to zero. So be careful, and none of these are recommendations…they are just ideas that I have invested in among others. I’m a beginner/novice investor.”

If anyone wants to learn, I believe there is a thread here somewhere which recommends Peter Lynch, Buffett etc. etc.

Learn from the experts not the total novices with next to zero track record like me.

Sold my LUNE position just now for 302.3, which net of a divi is a 3% loss.

Sold it due to Omicron.

Quick update

SLNH which I exited recently has tanked to 10.00…so happy to have got out. As I mentioned, I think it’s still a great biz plan so am looking to get back in at some point.

Usual caveats…

- penny stocks like these are high risk, can drop 30% the next day for no reason, and can go to zero.

- none of these are recommendations…they are just some ideas that I have invested in among others.

- I’m a beginner/novice investor.

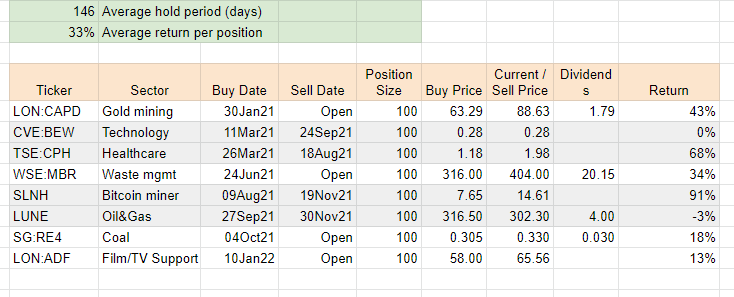

Comments on my little selection of my portfolio

Have added dividends as the return from RE4 is mainly in dividends for me, with share price appreciation a bonus.

CAPD still at 80 mark. I have a target of between 1.00 - 1.60 in the next 6 months for it so holding on.

MBR this is a long term GARP stock for me. 28% so far…happy with that. Results from last Q were good.

SLNH - that one dropped to 10.58 on the Bitcoin dip…so I timed my exit well on that one. As I said…a very volatile one. And I’m watching Bitcoin price to potentially get back into this one.

LUNE…exited too early on Omicron fears…never mind…one for the lesson bank!

RE4…just waiting for the next quarterly earnings and dividend announcement. I reckon USD76m earnings in Q4 which I think is about 24% of the market cap (at the price I paid for it).

Just bought ADF on the UK AIM market for 58p

CAPD started moving up as they announced buybacks. Was previously stuck below 85.

MBR past the 400 mark which is nice. Insha Allah it can stay above 400 now.

RE4 has also started buying back stock (which makes 3 out of these 8 done/doing buybacks, including CPH which did buybacks). It’s not moved up further, mainly I think to the Indonesian govt banning exports for a month, which if it is just one month wont affect full year profit. But…they might extend the ban who knows.

ADF just bought on Monday has had a nice initial kick. It listed very recently and I thought the valuation looked really cheap and it should re-rate. Obviously it’s tricky to ensure it’s not a “value trap”.

Prospectus for ADF is here which explains a lot of the things I look at…https://facilitiesbyadf.com/wp-content/uploads/2021/12/Facilities-by-ADF-plc-Admission-Document.pdf

are any of these stocks on robinhood?

No idea. I don’t use Robinhood.

The ticker I have in the table is the google ticker.

You’ll have to have a look.

Bear in mind none of these are recommendations - just sharing a some of what I’m buying/selling.

I am honestly a beginner investor.

These are penny stocks so can go to zero.

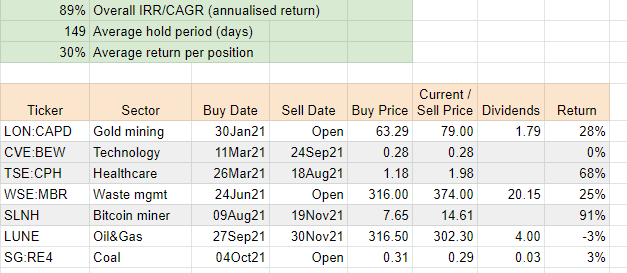

Alhamdullilah ma sha Allah despite the market correction, my picks are up in January an average of 9%, with the market down 10%.

Just some interesting stats:

FTSE AIM -10%

Nasdaq -10%

My picks

RE4 +11%

CAPD +9%

MBR 0%

ADF +16% since I bought, +23% in January

Average: +9%

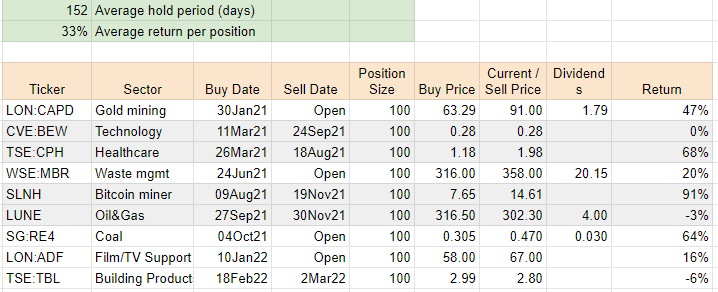

Another commodity-related investment. This time it’s Lumber.

Ticker is TBL. Company is called Taiga Building Products.

Listed in Canada.

Bought for 2.99 (currently 2.93).

Am not expecting this to be for more than a few months…let’s see what happens in the context of this pretty challenging market.

If anyone wants, I could do a “very quick pitch” on this stock, maybe even on a zoom call.

Click the like button thing if you are interested and I’ll see what I can do. It’s not the simplest to explain - but basically it’s about a projection of cash generation.

Usual caveats…

- penny stocks like these are volatile - they can drop 30% the next day for no reason

- none of these are recommendations…they are just some ideas that I have invested in among others.

- I’m a beginner/novice investor

PLUS…the general stock market is looking pretty weak at the moment so that adds to the risk here.

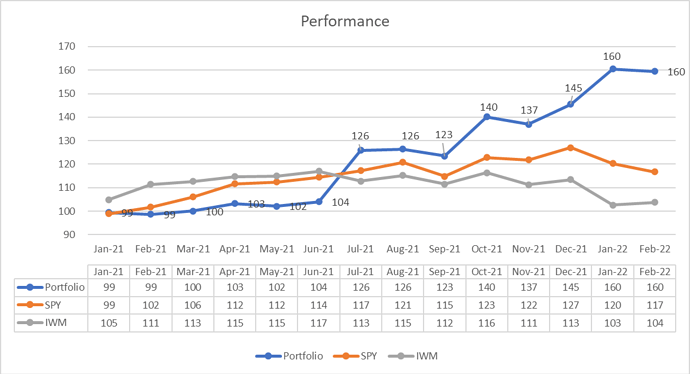

This is just a chart showing the performance assuming a 5 stock portfolio of these picks, starting with 100k.

I’ve compared to SPY (S&P500) and IWM (US Small Caps).

Alhamdullilah ma sha Allah not bad, and insha Allah I can keep something like this going…

Sold my TBL position for 2.80.

I recognised a loss here of 6%, but decided to take the L on this one.

Sold because the results were a bit of a disappointment.