Bought a position in GUI (Guillemot), a French gaming products company.

Downside risk is … recession impact difficult to quantify.

Sold my SQZ. (Serica position) for 253. 6% loss

Sold GUI for 10.18. 25% loss ouch.

Bought VNRX at 2.23

Looks like US inflation is coming back.

Which logically would mean higher interest rate levels, which would be bad for markets.

Personally expecting markets to bottom before the end of this year, i.e. the low is ahead of us, not behind us. But let’s see iA.

Pls tell us a bit about STX. I have not come across this one, Plan to look it up

Key points, happy to discuss further:

- Operates motorways in Poland.

- Owned by bigger private company that is in the same industry

- Net Income 90, MCap 700, EV 391. So very cheap when you adj for cash

- I think it dropped recently due to Ukraine war. I bought when it looked like it had based out. I don’t think Putin is invading Poland anytime soon hence I think that is low risk, albeit a risk.

- Am hoping iA for continued divis and a re-rate. It has historically been very cheap though so not expecting a huge re-rate.

- Overall seems as safe a place as any to hide for what I’m expecting to be a tough investing year.

thanks for your reply. Do you buy polish companies on WSE directly?

Yes I buy on the WSE exchange. I use IBKR as my broker.

I’ve only ever bought two Polish stocks - MBR and this one. Poland is generally just cheaper than other markets, e.g. LVC, APR are two GARP style stocks. I don’t do GARP but these seem to fit the criteria. Plus I had some Polish friends at university - nice people, so maybe I’m biased!

I use IBKR as my broker

I wanted to ask about this. I’m aware they enable securities lending (sadly like most brokers) and as far as I’ve researched, securities lending is Haram. How do you navigate this?

BarakAllahu Feekum

My understanding with IBKR is:

- In general, it is optional for you. So you can decide not to opt in to IBKR lending your securities.

- With certain account types, it is legally not allowed to lend securities. e.g. an ISA in the UK. (An ISA is a tax wrapper where the gains don’t get taxed). So on those accounts it’s not an issue.

So in this way, one is not participating in the haram activity.

But let me know if you understand it differently.

JazakAllahu Khayra for your response.

-

How did you manage to opt out? I was under the impression it’s enabled by default based on limited research which put me off creating an account with them - I’d make an account if i can opt out.

-

Yes that’s what I’ve found too - I have an ISA with freetrade to get around their recently introduced securities lending. (I am considering moving to Trading212 as they’re ISA is free and they have a greater range of stocks than Freetrade)

I had looked into IBKR solely to enable me to invest in shares in other markets like the Turkish market which neither Freetrade or Trading212 allow

My understanding is that it is an “opt-in”. i.e. you don’t have to opt out as the default is opt-out. But maybe email them to find out? I thought they offered it as a way of making more returns.

I moved to IBKR for the same reason, plus FX translations are done at spot vs 1%+ in other UK brokers.

I use IBKR. I do not lend securities. I think you have to opt in. Lowest transaction and forex charges as well.

@UmarA I invest in Poland and i agree with many of your findings. It is a place where you can find Value + growth. Curious, what made you sell MBR. I own that. It did well and has come off but very cheap and has a high dividend payout policy. I also own the other two names you mentioned. I’d say APR is growth at a value price. LVC - richer valuation but look at those margins, cash flows.

I think you have an eye for that. Maybe you could pursue a bit of GARP plus your current approach. That is essentially what the Lynch approach is. It has fast growers but adds the cyclicals, stalwarts that help diversify the strategy and provide balance.

I sold for two reasons:

-

I was concerned about the impact of the Ukraine war on Eastern European spend on waste management. I thought that maybe Eastern Europe would decide to effectively allocate more spend to defence vs waste management and this might lead to reduced revenue growth and margin hits.

-

Also, the Ukraine war I think meant some investors maybe wanted to exit Poland as Poland is close enough to Russia to worry about it being invaded.

Then when I looked at the technical analysis it backed that opinion up as the stock was trending down, but that would have admittedly been partly confirmation bias I admit.

I’m open to going back into the position, as these boring companies are sometimes great opportunities (as I know you already know), but then the p&l has deteriorated so that bothers me at the moment.

I would be interested in your perspective @adib

In terms of me pursuing GARP, I agree with you entirely. This year I want to look into it and start taking positions and seeing what happens iA.

Your point 2 is somewhat valid. There was selling post war and then high inflation and rates also hurt. The PLN depreciated 20% relative to USD at one point in 2022. From Oct , things magically flipped both in currency and equities.

You are right last 2 quarters were a bit weak for MBR. Could be seasonality. But its very cheap and its track record is good. Things don’t always work out in smooth straight lines each quarter/ year for any business.

Good luck. Interesting to find someone looking far out as Poland. Most look in home country.

“Note that this isn’t compliant per Zoya…because I’m using debt/assets as opposed to debt/market cap.”

Regarding DAC, can I ask when one assess Sharia compliance, what is the difference between these two approaches.

I’m interested in DAC, and also it will help me in future while assessing Sharia compliance, hence asking. Appreciate if you are able to clarify, thanks.

Zoya, which follows AAOIFI, requires total debt to be less than 30% of market cap.

This other way requires total debt to be less than 30% of total assets.

DAC fails the former, but passes the latter. Hope that helps!

Exited $VNRX and $STX. Nothing wrong with either company…I just would rather have my cash earning returns 3-4% in a UK halal bank given the current market risks. i.e. risk/reward not right for me.

Note the very important point that I’m a short term investor…i.e. if you’re a long term investor then please don’t debate me, and just hold through any market correction as you planned.

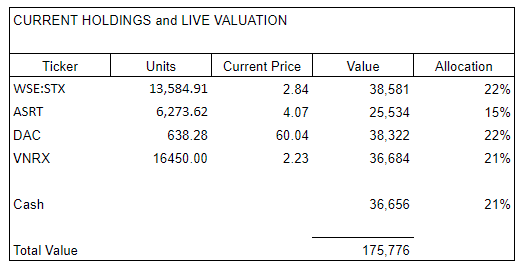

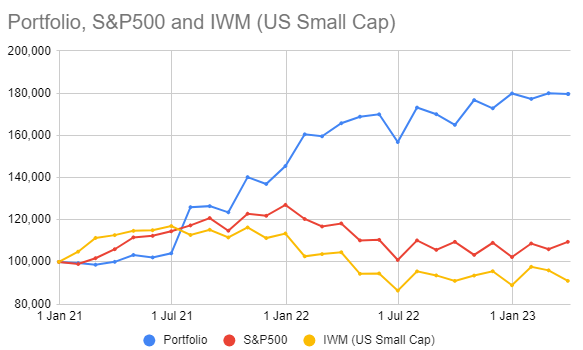

Lost 21% on VNRX, made 8% on STX. Portolio +5% YTD and +89% in nearly 2.5 years.