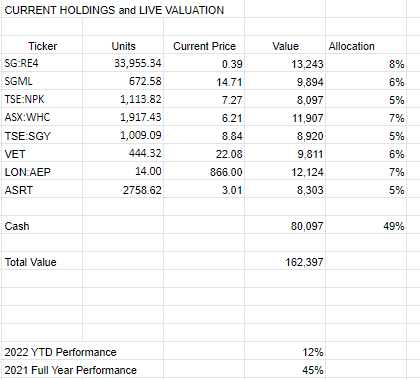

+8% 2022 H1 (1 Jan-30Jun) performance

+45% 2021 Full Year performance

+56% Performance since 1 Jan 2021

Full transaction list here:

+8% 2022 H1 (1 Jan-30Jun) performance

+45% 2021 Full Year performance

+56% Performance since 1 Jan 2021

Full transaction list here:

Thanks for sharing this!

Bought ASRT (spec. pharma turnaround) for 2.90.

Recent buy ASRT currently 3.46, +19% on the buy of 2.90 a few days ago.

Overall portfolio +16% this year so far.

Alhamdullilah ma sha Allah.

Portfolio +19% from Jan to July this year. +45% last year.

RE4 and WHC: Coal stocks. Coal prices have stayed high. Key risks obviously are coal price, and jurisdiction.

SGML: LIthium. Requires production to ramp up.

NPK: Fertiliser. Requires production to ramp up. Fertilizer prices have come off the boil

SGY and VET: Oil and Gas. Oil has stayed stubbornly above the $100 mark, despite China lockdown and recession. Bull case is that it will stay high due to lack of new supply. Bear case is that recession will pull the oil price down.

AEP: Palm Oil. As mentioned, the 50% shareholder lady passed away recently, so I’m guessing investors are seeing the likelihood of a big divi/buybacks increasing. Again there is a risk of Palm Oil price.

ASRT: Speciality pharma turnaround. Too cheap, just needs to continue execution and get noticed, although it has actually risen 34% since I bought it about 10 days ago.

General market…obviously we’ve gone up recently after the Fed meeting. I personally think the risk is still to the downside so holding c50% cash.

Salam , you got an update SGMl is 23! Ma sha Allah , still a good time to get in?

Wasalaam. Alhamdullilah SGML now +80% since March when I bought it.

Regarding your question, I’m sorry but I really don’t feel comfortable recommending things. I also don’t want to come across like I’m “ramping up stocks”.

I’m just sharing what I’m actually buying/selling with my real money, and happy to discuss in general terms a stock.

So with SGML, it’s not even in production yet so for me is quite high risk/return. I tend to focus on downside risk from an overall portfolio perspective and this is one of my more risky ones, but given I’m 80% up might also have a greater upside potentially, and my downside is protected now. It’s lithium so can also easily get caught up by hype. Sorry that doesn’t answer your question - hope that helps.

Khayr its fine , whats your plan for sept since its the worst month for the stock market right?

I don’t have any specific plans for September…I treat it like any other month.

Sold my AEP for 922.00. Wasn’t happy with the latest earnings.

Sold my RE4 for 0.40. Better opps elsewhere.

Got some things on my watchlist to add back into the portfolio.

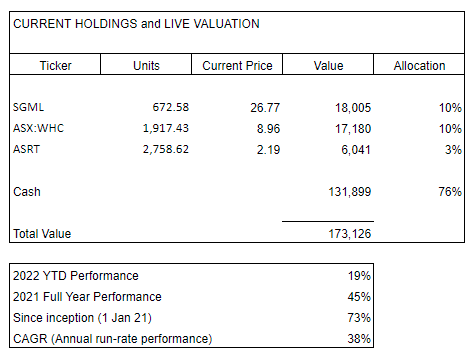

Performance currently at +78% since 1 Jan21. +22% YTD.

Just want to elaborate on the high cash position. Don’t want to get into a debate about it…just sharing a rationale:

Holding high cash is not a long-term position. Few months iA.

I do have a market-timing method that I have confidence in and that is saying to hold high cash. I do appreciate that most of the conventional things you read on the internet say “you can’t time the market”. I believe I can get it right enough times that it pays off, i.e. it doesn’t need to be right every time.

I do also have a view on the macro-economic fundamentals. In summary

Therefore…from a pure macro-economic standpoint and ignoring any market-timing models, personally I think the stock market is going to go down. So I have two “data points” saying the same thing.

Am not saying I am predicting a big crash, just that I think there is a high risk of a material correction.

So…in a situation where let’s say there is equal chance of 10% up and 25% down in the stock market…in that situation (which is unusual)…I prefer to hold high cash for a few months.

No-one can predict and I’m not predicting. I could be wrong here. It is just probabilities and managing risk.

Sold NPK, SGY and VET for losses of 38%, 8% and 3% respectively.

Cash now 76%. Am expecting market to be volatile in the next few months…note I’m not saying I think it’s going to crash…just that I think it will be volatile to staying more in cash.

Taking some profits on SGML…sold half for 24.74…90% profit in 6 months alhamdullilah.

82% cash now.

Salam bro,

Salam alaykum,

I invest in stocks, but the markets are very bearish.

Do you know how I can invest in sukuks?

And on the raw materials in a lawful way?

Wasalaam.

Create a new thread for this, in the general forum, not please. Can answer it there.

Need to know which country you are in because with sukuk, it depends where you are.

Raw materials are generally very difficult to invest in in a halal way…will discuss in your new thread iA